By | Azrina Binti Md Saad

Fraud is a big challenge for all organizations. It causes severe problems across all types of organizations, from corporations, limited liability companies, partnerships, and even to non-profit organizations. Curbing fraud activities has become a difficult challenge once it takes place. No matter which line of business, the reality is that employees and non-employees commit fraud.

Fraud is defined as an act or course of deception, intentional concealment, omission, or perversion of truth:

1. to gain an unlawful or unfair advantage,

2. induce another to part with some valuable item or surrender a legal right, or

3. inflict injury in some manner.

Fraud should be taken seriously in all businesses but even then, why do some employees still choose to risk their integrity to commit a fraud? Although, the main reason of fraud is greed, there are many other motivation behind it and they should be looked into more in depth.

First and foremost, we must understand a human’s wants and needs. A human being seeks sustainable social, financial, emotional, and physical needs to feel good. Social needs such as belonging, affection, family, and friends are essential and basic needs. Financial needs, on the other hand, include income, savings, investment, insurance, and credit. The most essential financial needs is a stable income that covers all basic necessities such as food, housing, and utilities. Physical needs is usually closely related to financial needs, where people who lack financial security almost always also lack physical security. Feeling appreciated, respected and loved are some of the examples of emotional needs.

Hence, fraud can occur when any of the needs cannot be met.

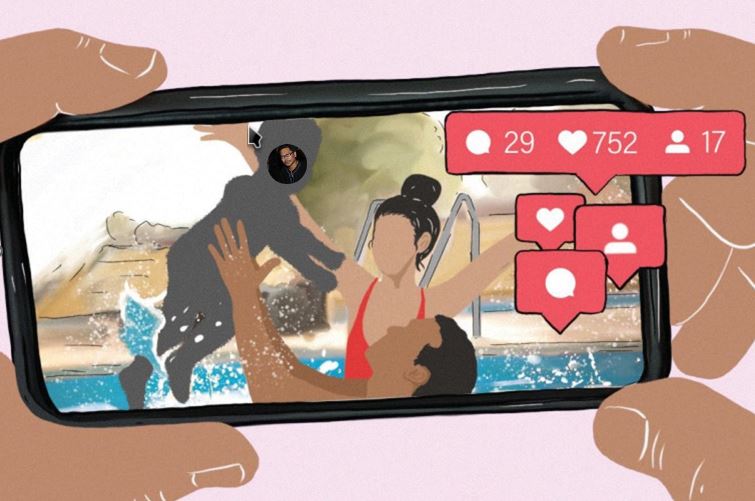

The Fraud Triangle is a classic framework designed to explain the reasoning behind a worker's decision to commit workplace fraud. The triangle represents three factors that are motivators for an employee to commit fraud: pressure, rationalisation, and opportunity. An employee in a stressful situation can view fraud as an easy way to solve his/her problems.

Figure 1 – Fraud Triangle

Motive/pressure/incentive

One of the motivations for an employee to commit fraud could be caused by pressure placed on him by other people such as his spouse, relatives and even friends. To satisfy their human needs such as social, financial, emotional and physical needs, as stated earlier, also acts as a great motivator for committing this crime. For example, someone who lacks financial stability and facing mounting pressure to pay off debt, maintain a high standard of living, pay off a medical bill, settle rent, or dealing with some sort of addiction can be a motivator for them to risk their integrity and commit a fraud. A person who is struggling financially have the urge to solve his problems by hook or by crook. Some of the common frauds in an organization range from stealing small office stationeries to business funds, claiming benefits which an employee is not entitled to, abusing a business trip by making it a personal vacation or even as simple as misusing the annual leave.

Rationalisation

Rationalisation is the means by which an employee attempts to explain or justify their behaviour or attitude with logical reasons, even if they are not appropriate. An employee who has committed a fraud will attempt to justify his wrongdoings to overcome the ethical barrier of their conducts. Some of the reasoning used to justify their crimes are as follows:

- they have not been properly paid for their duties therefore they deserve to steal from the frauds.

- their employers can afford to absorb the financial losses

- they could lose everything if they do not commit the fraud

- they justify that “everybody does it”

Opportunity

The third element in the fraud triangle is opportunity. Even with motivation and rationalisation, a fraud cannot take place if a preparator does not see an opportunity to commit it. Weak internal controls, low likelihood of detection, lack of policy enforcement, inadequate security, or misusing their position of trust to get some personal gains, are some of the opportunities a perpetrator can make a move. For instance, when an employee was given a company car to utilise for business purposes, he sees it as an opportunity to misuse it for personal reasons.

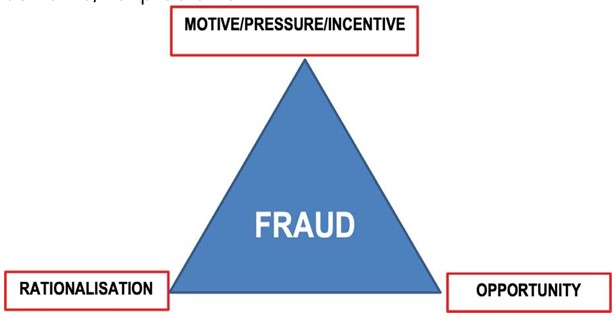

The original fraud theory was developed by Suther Edwin Sutherland and Donald Cressey and ever since then, the conceptual framework of the fraud triangle has been expanded by other experts to relate to social influences, integrity, arrogance, competence, personal greed, and employee deprivation. In this new development, the capability element has been added to the three initial fraud components. This new edition of the fraud conceptual framework is called the fourth leg of the Fraud Diamond, and this was first presented by Wolfe and Hermanson in December 2004. Figure 2 below shows the diagram of the Fraud Diamond Theory.

Figure 2 – Fraud Diamond

Some people possess a mindset that they could commit ethical violations or break the law without having any sense of guilt or stress. The mindset traits that support such capability include position, intellectual capacity, ego, coercion, deceit, and stress management.

Position/Function (Role)

The position or the fraudster’s function in an organization plays a crucial role in the capability for them to commit fraud. Most of the fraud in the workplace occur because the employee has an exemplary ability to commit the fraud. They usually have knowledge on organisational policy, existing internal control, and security weakness and use them to commit a fraud. One of the critical factors in enabling someone to commit fraud is the function or position he/she holds in an organisation. Many scams occur when the right people are placed there with the ability to commit fraud. An employee who holds a certain position and function in the organisation may have the opportunity and capability to breach the organisation’s trust.

Intelligence/Creativity and Ego

A fraudster is typically someone who understands the internal control’s weaknesses and can exploit these weaknesses by using their position, function or authorised access. According to the Association of Certified Fraud Examiners (2003), 51% of the criminals of occupational fraud had at least a bachelor's degree, and 49% were over 40 years old. Also, managers or executives committed 46% of fraud, based on the Association's recent study (Rabi'u Abdullahi and Noorhayati Mansor 2015). Usually, the fraudster has a heightened ego, and they believe that nobody will notice the scam that they are doing. They also assume that they could easily get out of it if they ever get caught due to their high position.

Coercion, Deceit and Stress

Coercion and deceit are methods where the individuals can influence others to assist or conceal the fraud, and the fraudster is able to lie or divert convincingly. A fraudster usually has a very persuasive personality in order to convince others to go along with the crime. A common personality trait of these preparators is asserting themselves as “bully” to people that work below their hierarchical position. They would make unusual and significant demands by instilling fear into them. The preparators, on the other hand, do no respect and they avoid being subjected to the same rules and procedures as others (Wolfe and Hermanson 2004:41). According to Wolfe and Hermanson (2004) and Rudewicz (2011), a successful fraudster could lie effectively and consistently. They could lie to the higher authority such as investors and auditors convincingly without being suspected. They also have to be cunning and smart in order to keep track of their lies so their storyline remains consistent.

Furthermore, a vital characteristic of a fraudster is the ability to handle immense amount of stress because committing a fraud and managing a scam over a long period of time can be stressful. A fraudster has to be smart to maintain their calm and keep their act concealed to avoid detection.

The impact of high-level fraud can affect an organisation in several ways such as financial impact, deterioration of reputation and employee morale. The main consequence of fraud is loss of funds or equipment followed by damage to reputation. This may negatively impact long term reliability and deter future clients and customers. In addition, fraud committed at the highest hierarchical could damage internal trust of existing employee.

In conclusion, by understanding the reasoning behind a fraud using the Fraud triangle theory, an organisation should be able to cultivate good practice and measures to deter and detect frauds. An organisation must establish and maintain internal controls specifically designed to prevent and detect fraud before it is too late. It can conduct regular audits in high-risk departments such as financial, procurement or inventory department.

Another method of preventing fraud from occurring is by implementing an information security management system (ISMS) in an organisation. Fraud can occur due to the ineffectiveness of the current Information Security Controls which can be caused by the weakness in people, process and technology governance as well as valuable business data. For instance, if an employee is able to alter the data, this may lead to a fraud meaning the basic information security principle of confidentiality, integrity, and availability has been breached. Therefore, key security control areas of data access and management are extremely crucial for fraud prevention.

An organisation can also establish strict hiring procedures to conduct a thorough background investigation on a prospective employee’s educational and employment history. Training should also be provided to all employees on how to prevent fraud and regular audits in high-risk departments such as the financial, procurement or inventory department.

It is a challenge to manage fraud especially if the person committing is someone from a high hierarchical position within an organisation The capability, which is the fourth element in the Fraud Diamond theory, states that hierarchical power such as position or role allows a person to abuse the privilege given in the company to commit a fraud. The person also has to have the confidence they can get away without being caught.

It is hoped that the capability element will be used effectively to fight against fraud and as a step towards shifting from a trust-based model to a process-based model. For example, an organisation could take precautions and make sure that no one is in the Fraud Diamond category and also to create awareness among employees that fraud, by all means, is an ethical breach and a crime.