By | Mohamad Hafiz bin Rahman

Introduction

Money laundering is the process by which criminals attempt to conceal the origin and ownership of proceeds from their illegal activities. Criminals attempt to convert the proceeds of their crimes into funds that appear to be of legal origin through money laundering. If successful, this process gives validity to the transaction committed by the criminal.

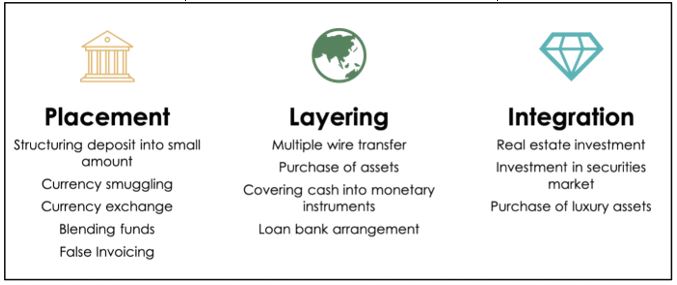

Money laundering can range from a relatively simple process conducted locally or nationally, to a very sophisticated process that leverages the international financial system and involves many financial intermediaries over various jurisdictions. Money laundering is necessary for two reasons. First, the perpetrator attempts to disassociate from a crime that gives rise to the outcome of a crime (known as a predicate offence) and additionally, the perpetrator could use the outcome as if it was permissible by law. In other words, money laundering disguises the criminal origin of financial assets so that they can be used freely. Figure 1 below explains the process of money laundering.

Money Laundering Process

Figure 1: Process of money laundering.

- Placement Stage

In the first stage, the launderer introduces the illegal profit into the financial system. This is the platform where the criminal breaks up a large amount of cash into less conspicuous smaller sums that are deposited into a bank account, or by purchasing a series of monetary instruments which will be collected and put into an account in another location.

2. Layering Stage

In the second stage, the money is converted or moved further from the original source by channelling it through the purchase and sales of investment instruments, or the launderer may simply wire the funds through a series of accounts at various banks around the world.

3. Integration Stage

In this final stage, the launderer will join a legitimate business economy. The most common example is where the proceeds are injected into a legitimate business that has a high percentage of cash sales such as investments, business ventures, and luxury assets.

Tactic and Technique

In each stage of the process, money laundering can use a variety of financial methods and instruments to disguise the illicit nature of the crime proceeds. The methods vary from purchase of simple luxury goods to more sophisticated techniques that involve transfer of money through transnational networks of banks and other financial institutions.

To deal with all illegal proceeds, money launderers can use financial or non-financial mechanisms, that is, institutions that (intentionally or unintentionally) participate in the money laundering process. The most commonly used method is to work through a banking institution, especially in the first stage of money laundering. Besides banks, other sectors were also used, especially financial intermediation, with a higher interest on invested capital leasing (the process of granting use or occupation of property during a certain period in exchange for the lease to be determined), and factoring (the practice of receiving accounts that can be accepted as a short-term loan guarantee). Other financial institutions, such as wire-transfer companies and exchange offices, are also often used to launder illicit profits.

Lastly, money launderers will use the gold market, casinos, and gambling houses. The instruments used for money laundering operations are also very wide ranging. Besides cash, the instruments most commonly used are stocks, life insurance policies, letters of credit, bank cheques, wire transfers, and precious metals.

Effects of Money Laundering on the Economy

Money laundering damages financial sector institutions, which are essential for economic growth by promoting crime and corruption, which will ultimately slow economic growth and reduce efficiency in the real economic sector. Money laundering is the main problem not only in the world’s major financial markets, but also in emerging markets. As emerging markets grow their economies and financial sectors, they are becoming ideal targets for money laundering activities. Money laundering also causes large fluctuations in international capital flows and exchange rates, as well as unpredictable changes in the demand for money.

In financial institutions, sudden changes can occur in the assets and liabilities of their financial position that are perceived to be used in money laundering. This will create risks for the institution. News of money laundering by these financial institutions may attract the attention of the authorities. In addition, audit pressure on these institutions will increase, and the reputation of those institutions will be damaged.

These illicit proceeds could dwarf government budgets of some developing market countries, leading to the loss of government control over economic policy. In certain situations, the sheer size of the laundered profits asset base may be leveraged to corner markets or even small economies.

Money laundering can also have a detrimental effect on currencies and interest rates as launderers reinvest funds where their schemes are less likely to be detected, while rates of return are higher. This could increase the threat of financial instability due to the misallocation of resources from artificial distortions in assets and commodities.

Money laundering will reduce tax revenue because activities taking place in the underground economy are undeclared. This has a negative impact on the economy as a whole and gives illegal businesses an unfair competitive advantage over those operating legitimately. It will also result in reduction in tax revenues. If this income is low, it will raise the possibility that public revenues will not meet public expenditures, thus causing budget deficits.

Anti-Money Laundering (AML) in Malaysia

The Anti-money Laundering, Anti-terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) is the primary statute governing the AML/CFT regime in Malaysia. The Act was gazetted as law on 5th July 2001 and came into force on 15th January 2002. The AMLA provides for the offences under money laundering and terrorism financing and the measures to be undertaken for the prevention of money laundering and terrorism financing offences.

The AMLA provides wide-ranging investigation powers, including powers for law enforcement agencies and public prosecutors to freeze and seize properties that are involved or suspected to be involved in money laundering or terrorism financing offences, and the power of the court to forfeit properties derived from the proceeds of serious crimes.

The maximum penalty for a money laundering offence under section 4 of the AMLA - “any person who commits a money laundering offence and shall on conviction be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than 5 times the sum or value of the proceeds of an unlawful activity or instrumentalities of an offence at the time the offence was committed or five million ringgit, whichever is the higher”. In addition, not only money laundering will be punished, but failure to comply with anti-money laundering regulations will also be punished. In the case of minor non-compliance, the relevant regulatory agency may issue a warning letter to the relevant reporting agency. Although Malaysian banks and financial institutions are subject to anti-money laundering regulations, some institutions must also comply with anti- money laundering regulations. This is because these institutions have money laundering risks.

Conclusion

Money laundering has evolved to become a successful tool for criminals because the financial system failed to eliminate the possibilities. If criminals were provided with the opportunity to make concessions, the system could be misused and abused. Financial transaction systems are designed to provide a more secure payment system for businesses around the world. It generates detailed and permanent records of all financial transactions. Regrettably, oversight standards, rules, and laws are not applied consistently and universally. Flexibility is the key to money laundering success. The lower standards and weak legislation found in many countries provide the needed flexibility for criminals to exploit the system to launder criminally earned profits. In conclusion, money laundering is not a profitable undertaking but a destructive one. Therefore, we must always be mindful of the consequences that we will face and never get involved in this crime.